Corporate Structuring Can Be Fun For Anyone

8 Simple Techniques For Irs Unpaid Back Taxes

Table of ContentsThe smart Trick of Irs Partial Payment Installment Agreement That Nobody is Talking AboutWhat Does Tax Preparation Mean?The Best Strategy To Use For Tax ReliefNot known Incorrect Statements About State Of Michigan Sales Tax Solutions Not known Facts About Corporate Tax ConsultationMore About Corporate Tax Payment Agreements

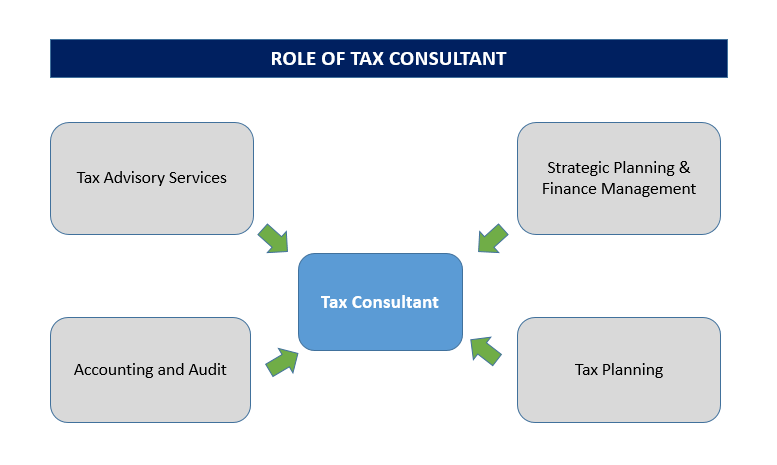

Typically credited to Ben Franklin is this renowned quote:"Absolutely nothing is particular with the exception of death and tax obligations." Several individuals discover tax concerns to be complicated and also onerous, and, instead of doing their own taxes, they usually prefer to hire a specialist (Accounting / Bookkeeping). Taxpayers that have significant assets or complicated individual finances, might decide to collaborate with a tax consultant, that can leverage her in-depth expertise and also experience to decrease her clients' tax obligations and also secure their passions.Tax legislations change regularly, and also several individuals as well as business owners are just not aware of the myriad of policies that regulate reductions, credit reports as well as reportable income. Consequently, the average taxpayer may make blunders that can cause the underpayment or over repayment of tax obligations. If the taxpayer underpays his taxes, he may be subject to an internal revenue service audit, with possible charges.

A tax obligation working as a consultant is an organization that supplies professional guidance to tax obligation filers. A good tax consultant understands tax laws, and also is able to recommend strategies that minimize responsibilities while also minimizing the opportunity of an audit that might bring about a dispute with the IRS or with a state tax firm.

Not known Factual Statements About Corporate Restructuring

A tax obligation preparer is somebody who prepares income tax return, such as the 1040 or 1040 EZ, for others. The profession is freely managed: tax obligation preparers normally complete a brief training program, register with the internal revenue service to receive a tax obligation preparer number, as well as, in some states, must sign up with the state agency prior to beginning job. click here now.

Helping customers with tax problems during and also after a significant life transition, such as a marital relationship, separation, fatality of a spouse or birth of a youngster. Finishing intricate tax obligation types and also timetables that many tax preparers are unknown with. Standing for a client in transactions with the IRS or various other taxation agencies.

Here are some typical demands for ending up being a tax obligation expert: Becoming a tax obligation preparer typically only requires completing a short training program. Some states, such as California, call for tax preparers to finish a program approved by the governing company that signs up or certifies preparers. Individuals who want an occupation as a tax professional need to ask their state's governing body to provide them with a listing of approved course suppliers (discover here).

An Unbiased View of Irs & State Of Michigan Tax Offer In Compromise

Training courses sponsored by exclusive firms might be at no cost or call for just the purchase of some books. Oftentimes, people that succeed in these programs may be used work by the tax obligation prep company. An additional choice for those that want tax obligation prep work as a profession is to come to be an internal revenue service Tax obligation Volunteer.